Last year, Mike the Musicologist and I were talking about stuff. MtM suggested it might be interesting to take the money from our stimulus checks and invest it…in gun related stocks.

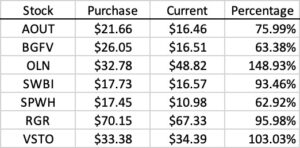

Thus was born what I refer to as “the gun hedge fund”, even though it technically isn’t a hedge fund. It is more just a collection of gun related stocks that I think have good growth potential. I have one (or in some cases, two) shares in each of the following companies:

- American Outdoor Brands (AOUT)

- Big 5 Sporting Goods (BGFV)

- Olin Corporation (OLN)

- Smith and Wesson Brands International (SWBI)

- Sportsman’s Warehouse Holdings (SPWH)

- Sturm Ruger and Company Inc. (RGR)

- Vista Outdoor Inc. (VSTO) (Fark REI.)

I haven’t really been “trading”, per se. I’ve bought these stocks to hold, and any dividends I’ve reinvested in more stocks. This is just for fun, and experimental purposes. It’s also a way to use money that I’d otherwise probably have spent on whisky and women, or just wasted.

This has been going on for exactly a year today. What have the results been so far? Well, I funded the account with $408.10. As of the close of the markets today, my positions (and accumulated cash) are worth…

…$417.82. So I’ve made $9.72 on gun stocks over the past year, or roughly 2.3% on my initial investment. That includes the dividends I’ve received and reinvested over the past 12 months ($21.38), so, on the whole, I’ve probably lost money.

Better than what I would have made if I put the money in a savings account. I’m not too stressed, since I’m mostly doing this for fun.

Who did the best? As far as I can tell, Olin (bought at $32.78, closed today at $48.82) and Vista Outdoor (bought at $33.38, closed today at $34.39).

I can’t find a way in the Schwab app to graph the entire history of this account over the past 12 months, but looking at the history of all of my accounts, I was actually doing pretty well right up until February 21st. Then my accounts fell off a cliff. I blame the Ukraine and the vertical integration of the broiler industry for that.

Two side notes:

1) For all the complaints I have about work, this job has let me personally own stock for the first time in my life. I already had a Schwab account because I’ve been buying company stock on the employee purchase plan, so it was easy to open a second account for the gun hedge fund independent of that. The hardest part was moving the money from my bank to Schawb. (I think I also had to send them an ID.)

2) My employee stock purchase plan had $205 cash in it that I couldn’t do anything with: I couldn’t buy more company stock, and if there’s a way to reinvest dividends, I haven’t found it yet. So yesterday I opened a second personal account, because I wanted to keep the gun hedge fund as a thing by itself, and bought…one share of Apple.

Apple closed today at $162.74. I bought this morning at $152.42, so I’m already up $10.32 on that one share of AAPL, or more than the gun hedge fund made in the past 12 months.

“Whiskey and women, or just wasted.”

I see what you did there.